doordash quarterly tax payments

If you will owe money on taxes this year you really want to think about getting a payment sent in by tomorrow if you havent already done so. In QuickBooks Self-Employed go to the Taxes.

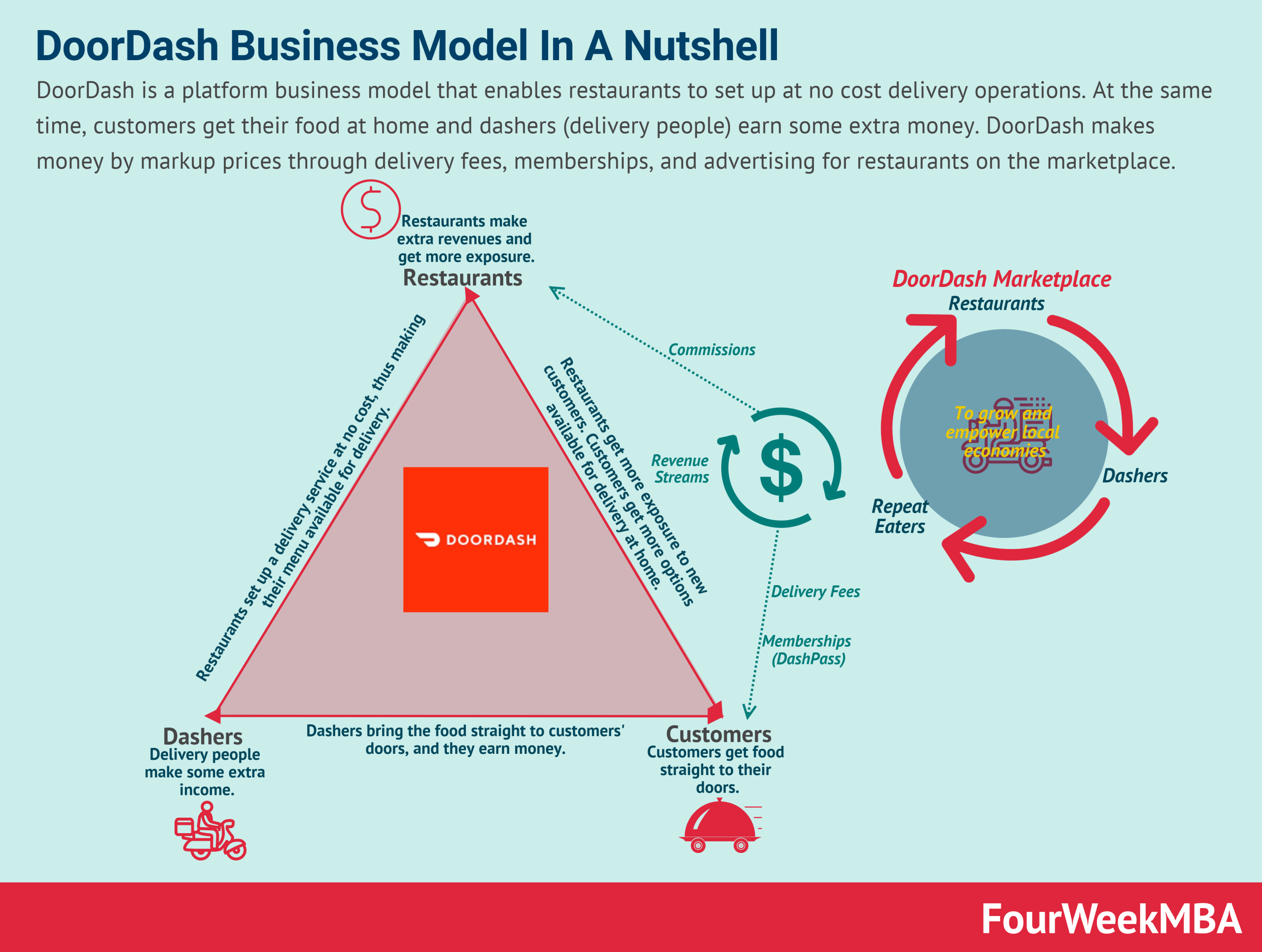

Nobody Wins With Doordash Examining The Terrible Economics Of By Tony Yiu Alpha Beta Blog Medium

Ad DoorDash ensures every order is accurate fresh and on time every time.

. Do you have to pay quarterly taxes for DoorDash. Subscribers may view the full text of this article in its original form through TimesMachine. Order from your favorite restaurants today.

For individuals only. Instead youll likely have to file taxes four times a year or quarterly. Order from your favorite restaurants today.

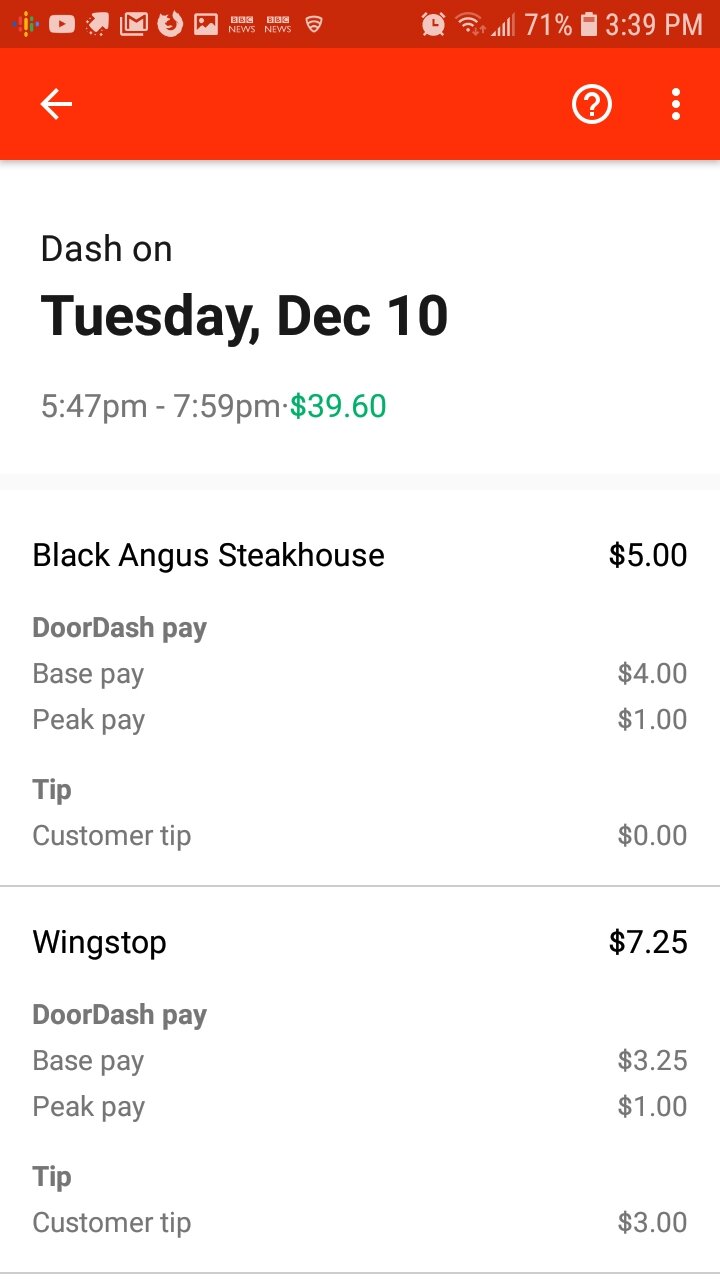

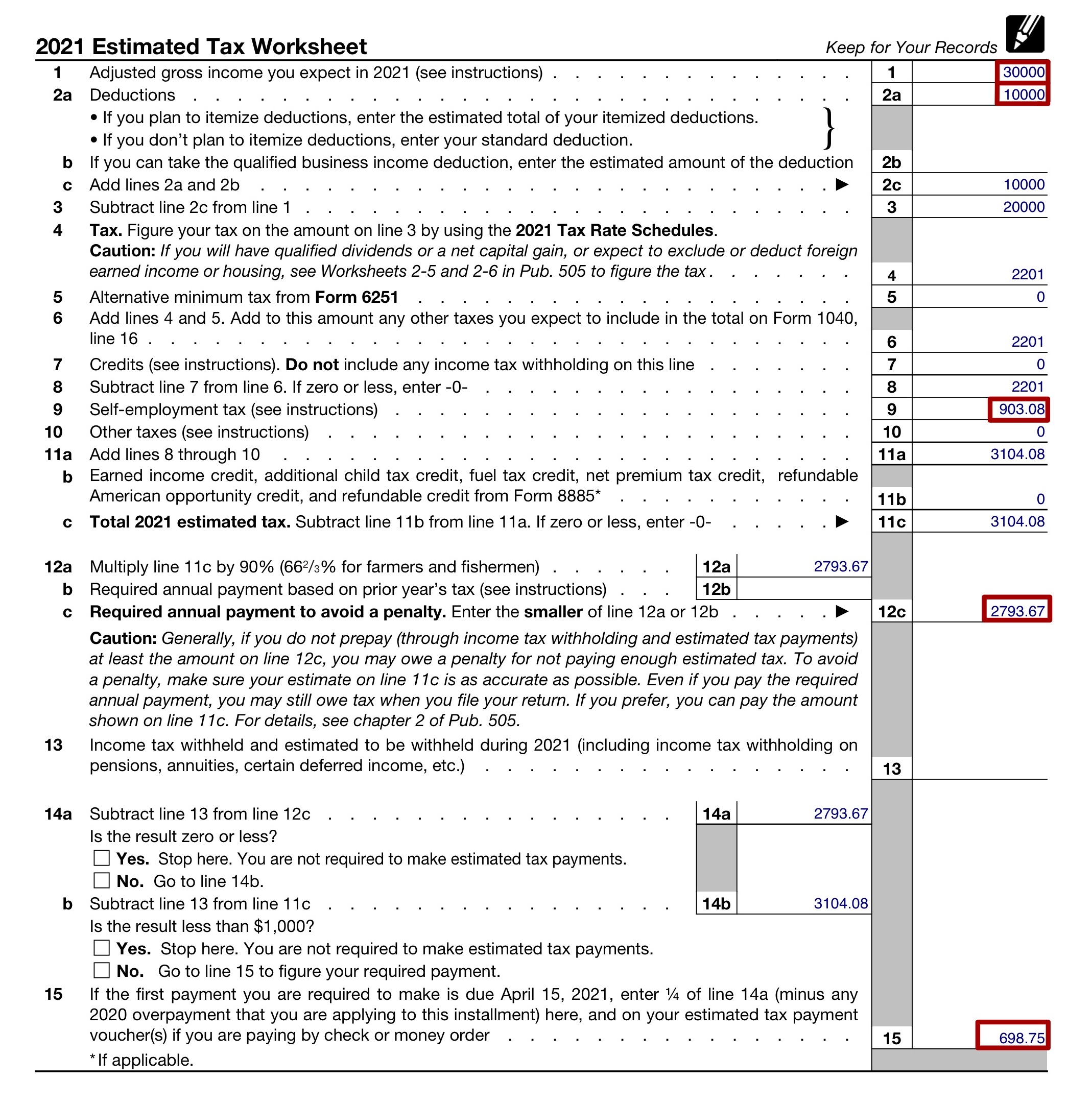

If you do not you will owe penalties and. If you made 5000 in Q1 you should send in a Q1. You do PAY quarterly taxes if you expect to owe more than 1000 in taxes by the end of the year.

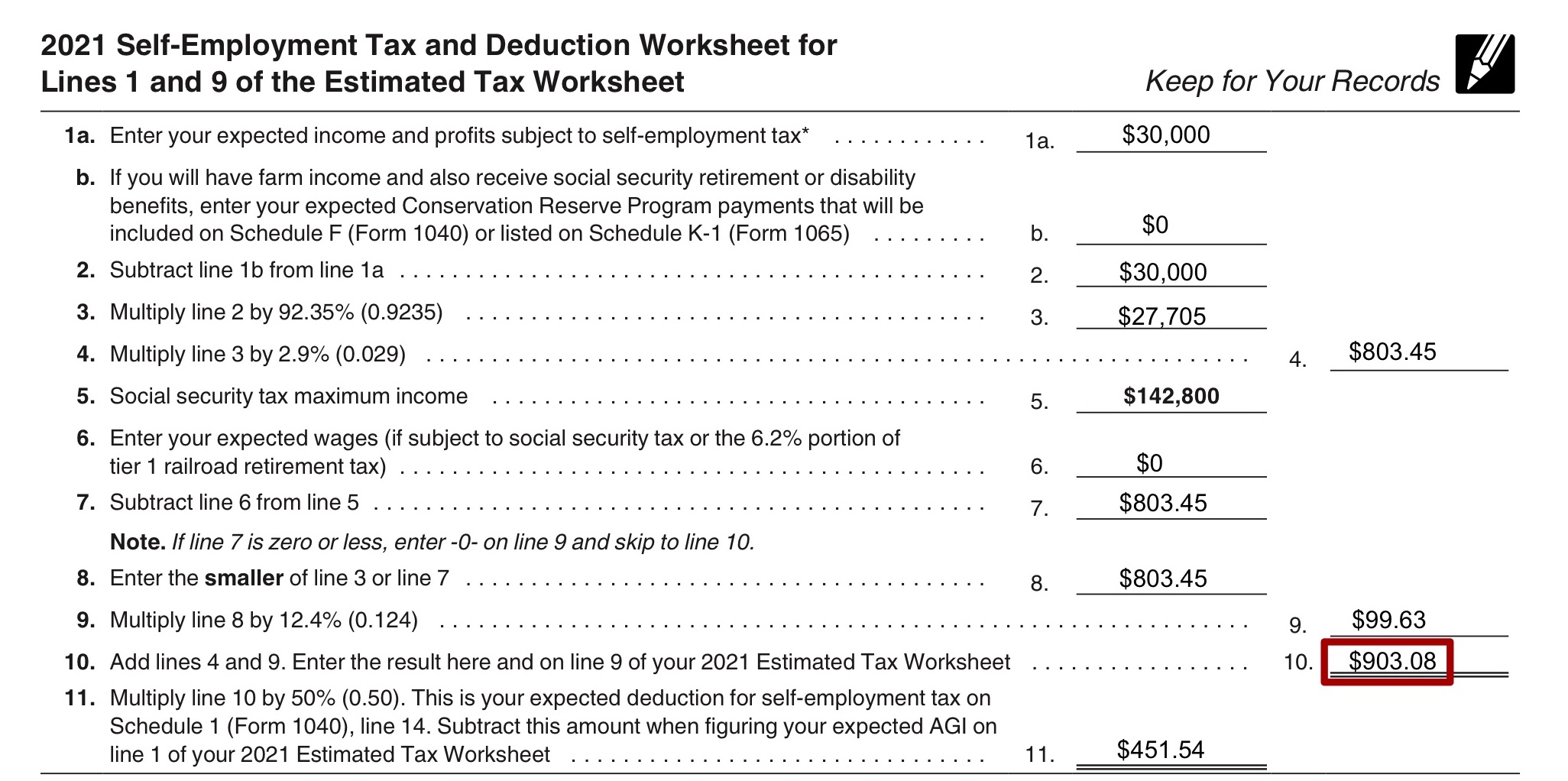

Expect to pay at least a 25 tax rate on your DoorDash income. While the traditional tax deadline is always April 15th the IRS expects independent contractors to pay estimated taxes quarterly. 2d qrly payment on 42 income tax due.

June 15 for the second. You can follow the step-by-step process of filing paying your quarterly taxes in QuickBooks Self-Employed. To pay the estimated taxes for Q1 you must total your DoorDash income for the quarter and multiply your income by 153.

Do you owe quarterly taxes. The IRS may suggest quarterly payments if you expect to owe more than 1000 in taxes this year. IRS doesnt want you to end up with a huge bill you cant pay.

No delivery fees on your first order. Since youre an independent contractor you might be responsible for estimated quarterly. But thats strictly an estimate.

Ad DoorDash ensures every order is accurate fresh and on time every time. No delivery fees on your first order. If you made estimated tax payments in 2020.

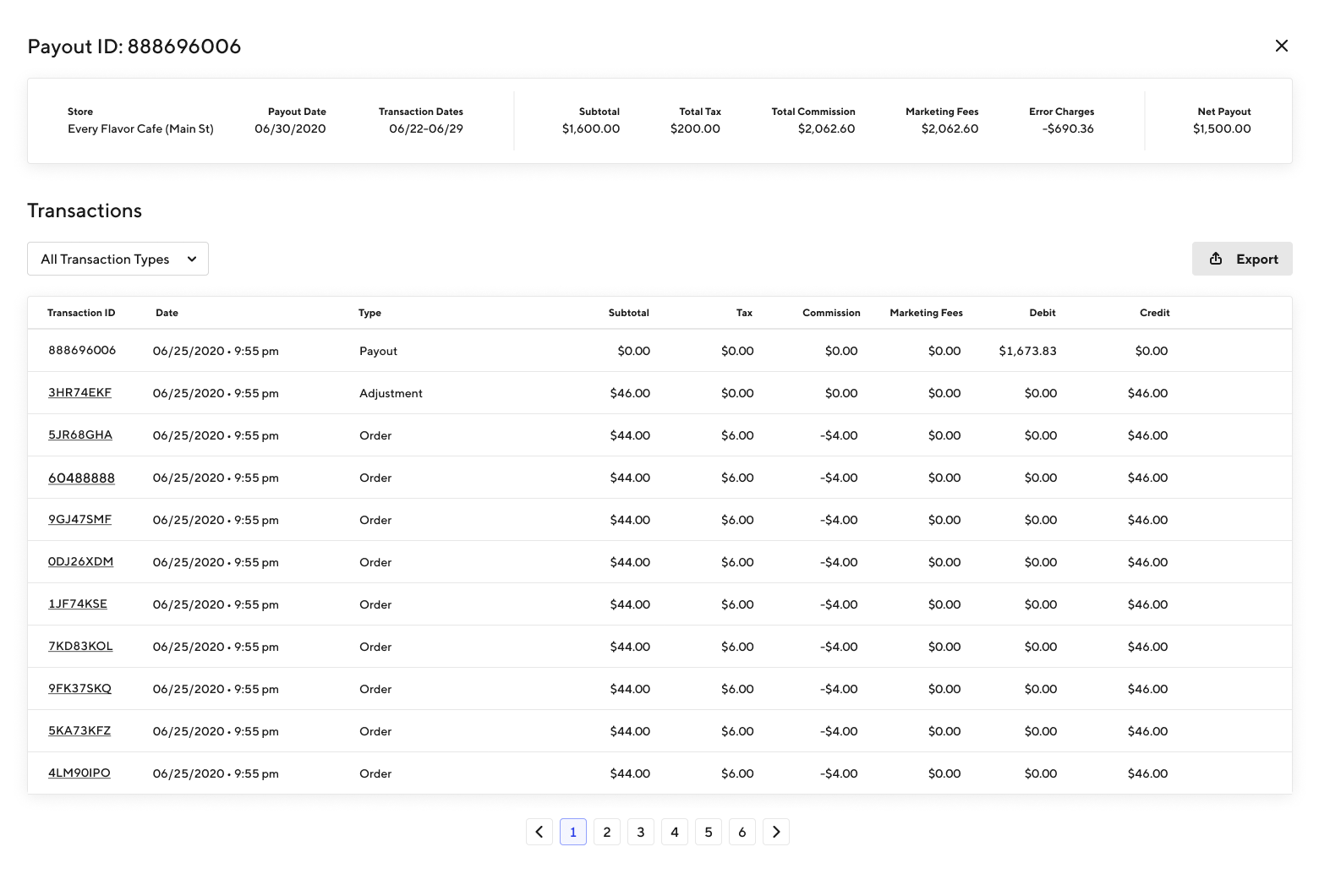

The governments quarterly financing and the income tax payments will make a turnover of close to 1800000000. When are quarterly tax payments due for Doordash delivery drivers. View the amount you owe your payment plan details payment history and any scheduled or pending payments.

Paying quarterly taxes which arent actually quarterly by the way takes literally 30. Support Specialist Current Employee - New York NY - July 4 2018. If you owe above 1000 in taxes from your gig job you will pay quarterly taxes.

The due dates for quarterly payments are. April 15 for the first quarter. Up to 12 cash back At DoorDash we promise to treat your data with respect and will not share your information with any third party.

You can unsubscribe to any of the. This is a substitute for the tax withholdings that employers. If you are expecting to owe 1000 or more on your return you are required to make quarterly estimated payments due 415 615 915 and 115.

Full text is unavailable for this digitized archive article. View Full Article in Timesmachine Advertisement. A great place to start.

Working at DoorDash is a fantastic way to jumpstart your way into the world of. Make a same day payment from. Either way your estimate should be about the same 25-30.

How To Do Taxes For Doordash Drivers 2020 Youtube

How Do I File Estimated Quarterly Taxes Stride Health

Tips For Filing Doordash Taxes Silver Tax Group

No Free Lunch But Almost What Doordash Actually Pays After Expense Payup

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash 1099 How To Get Your Tax Form And When It S Sent

Pro Door Dasher Shares Tips To Maximize Your Earnings

Dasher Pay Breakdown R Doordash

Tips For Filing Doordash Taxes Silver Tax Group

My Door Dash Spreadsheet Finance Throttle

Doordash Taxes Does Doordash Take Out Taxes How They Work

Doordash Taxes Does Doordash Take Out Taxes How They Work

Dasher Pay Breakdown R Doordash

My Door Dash Spreadsheet Finance Throttle

Prepare For Tax Season With These Restaurant Tax Tips

How Do I File Estimated Quarterly Taxes Stride Health

How To File Your Taxes As A Food Delivery Driver Grubhub Doordash Instacart Dumpling Etc Contact Free Taxes